5 ecommerce milestones to look out for in Southeast Asia (Startup Asia preview)

-

Don’t get Duped! Hire Right SEO Company

DT, , Emerging Technology, IT Strategy, Technology, User Experience (UX), Emerging Technology, Google, IT Strategy, search engines, technology, User Experience, 0

You might have come across some SEO companies which claim to provide complete success for your business. There are...

-

40+ Apps & Tools To Customize Your Facebook Pages

DT, , List, Startups & Branding, Technology, brand pages, branding, Brands, China, Facebook, Facebook Page, Google, India, social network, technology, United States, Web 2.0, 0

Facebook now has over 800 million active users around the world. If it were a country, it would be...

-

3 Really important Ingredients of a UX design company

DT, , Emerging Technology, IT Strategy, Technology, Culture, design interfaces, Emerging Technology, IT Strategy, plug-ins, Talent, technology, 0

Need leads to invention and invention leads to an end finished product which can make or break your company....

-

It’s Time to Say Good Bye to Desktop Accounting!!!

DT, , Cloud Computing, Emerging Technology, Zoho, Zoho Books, business applications, small business owners, small business singapore, ZOHO applications, ZOHO Books, 0

In Singapore, where small businesses are not capable enough to hire full-time tax professionals, CPAs or bookkeepers, online accounting...

-

Cop Uses 'Find My iPhone' App to Catch Thief

DT, , Reports, Technology, Find My iPhone, GPS, iPhone, iPhone app, robberies, smartphone, stolen, technology, tracking software, 0

A New York City cop put his tech skills to quick use last week, tracking down a stolen iPhone...

-

Infographic: Dot COM Domain Names History

DT, , Technology, Uncategorized, Domain Names, Domain Names History, Dot COM Domain, infographic, Web 2.0, 0

There are 101 million .com registered domain names in the world. Second is .DE with 15 million and third...

-

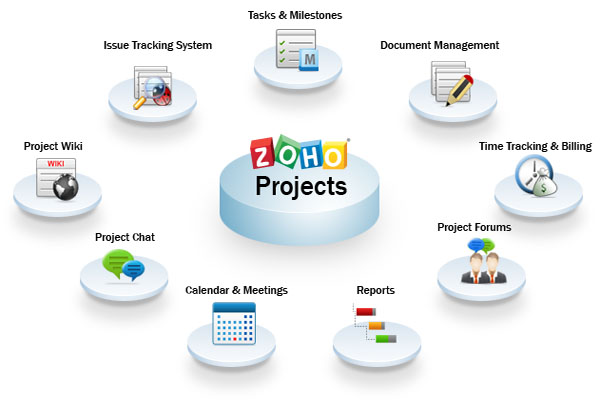

Zoho Projects- How it has defeated other Tools of Project Management?

DT, , Cloud Computing, IT Strategy, PaaS, SaaS, Technology, application programming interfaces, applications of Zoho, Cloud applications, cloud based project management, cloud-based, CRM, CRM applications, CRM product, CRM product of Zoho, CRM solution, customer relationship management, data integration points, Gmail, Google Docs, process of registration, services of web, Singapore, Singaporean business, Singaporean business industry, Social influence, technology, web-based tool, Zoho, Zoho CRM, Zoho CRM product, Zoho in Singapore, Zoho Projects, Zoho’s business apps, Zoho’s business apps for iPhone, 0

Zoho Projects is an effective tool for online project management. It is a cloud based project management tool...

-

Cross-border e-commerce in Singapore and Malaysia

DT, , Emerging Technology, Technology, User Experience (UX), ASEAN Economic Community, Ecommerce, Emerging Technology, Malaysia, Singapore, technology, User Experience, 0

Payvision, a payment solution provider has published a white paper titled “Cross-Border eCommerce in Asian Markets: Singapore and Malaysia“.