If you have a business in Singapore but you have not heard of the PIC by Inland Revenue Authority of Singapore (IRAS), then you are missing out a great opportunity that has come your way.

Why to Drive towards the Cloud?

The government of Singapore has introduced monetary incentives in order to increase the acceptance rate of the cloud computing technology.

Under PIC, businesses are encouraged to increase innovation and productivity by adopting cloud computing technology. Expenditure associated with acquiring cloud computing services will qualify for a great deduction.

Small and medium sized businesses of Singapore can take a great advantage of government funding scheme to get a complete funding for cloud computing for years, and also to get an allowance if they plan to drive towards the cloud.

SMEs in Singapore now have an opportunity to boost their business productivity by embracing rapidly developing services and tools of cloud computing, without concerning about the costs.

The benefit that businesses in Singapore can get by driving toward the cloud is that it will move the responsibility of managing their business infrastructure on the shoulders of the cloud service providers such as Zoho. With the help of these cloud services, SMEs in Singapore can focus on value-added innovations and information flows for the business

More Support, More Innovation

SMEs in Singapore must leap at the PIC opportunity. Cloud computing is the path forward for businesses in Singapore because it will help cut down the IT costs and improve productivity via outsourcing and divestment from proprietary and legacy hardware and software.

Through the schemes of PIC and PIC Bonus, businesses in Singapore cannot just minimize the cost of shifting towards the cloud, however in the shifting process, can get a bonus from Singaporean government for taking this initiative of moving towards this advanced technology. Many businesses in Singapore still do not believe that moving towards the cloud is no-brainer now, but indeed it is.

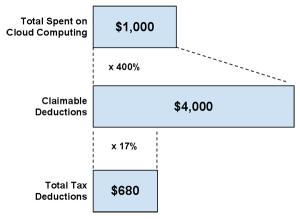

Many business seem somewhat jumbled by the PIC announcement for cloud adoption, it has made things complicated for them. Below is the explanation of how PIC and PIC bonus works.

How PIC and PIC Bonus Works?

PIC

This means that small or medium sized businesses which embrace cloud computing technology qualify for tax deduction of 400% or up to $400,000 of qualifying expenditure incurred per year. On a quarterly basis, businesses can now enjoy 60% cash payout for about $100,000 of the businesses’ PIC expenditures. Indeed, this makes the innovative and productive deployment of cloud computing technology much more attractive.

PIC Bonus

An additional incentive has also been added for those businesses which are planning to adopt the cloud computing technology. There will be bonus in the form of dollar for dollar, when businesses will spend about $15,000 for Year Assessment 2013-2015.

For instance, if a business spends $10,000 in the PIC qualifying activities, not just it will get 400% tax deductions or 60% cash payout, Inland Revenue Authority of Singapore will give that business extra cash payout of $10,000 when they make a claim. One thing worth mentioning here is that the PIC bonus is taxable

How XclueSIV can help you?

In Singapore, XclueSIV is a partner of two well-known cloud service providers “Zoho” and “Google apps”. Zoho provides on-demand affordable collaboration and business productivity applications to small and medium sized companies across the world, it has more than 8 million users. When we talk about Google Apps, then more than 5 million businesses use Google apps.

Our cloud specialists can guide you in getting PIC grant for adopting cloud computing technology.

Hello! I could have sworn I’ve been to this website before but after looking at many of the articles I realized it’s new to me.

Anyways, I’m certainly happy I came across it and I’ll

be bookmarking it and checking baack frequently!

Viisit my website https://penzu.com/p/c961de29