Alibaba to raise up to $24 billion in IPO, could soon be valued at more than Amazon

-

E-commerce hits new retail sales high

DT, , Emerging Technology, IT Strategy, Technology, E-commerce, e-commerce companies, e-commerce nations, E-commerce sales, Emerging Technology, IT Strategy, Singapore, technology, 0

Germany has moved up a notch in an index measuring nations' e-commerce sales. But a fresh study says online...

-

[Infоgrарhiс] IT departments are becoming ѕеrviсеѕ brokers in businesses

DT, , Emerging Technology, IT Strategy, Technology, business tесhnоlоgу ѕоlutiоnѕ, cloud ѕеrviсеѕ, Emerging Technology, Infоgrарhiс, IT departments, IT Strategy, mаnаgеmеnt-оriеntеd rоlе, technology, 0

With technology disrupting buѕinеѕѕеѕ and thеir processes аll оvеr thе world, it stands to reason thаt thе rоlе оf...

-

RedMart well on its way to capturing Singapore market, growing 20% every month

DT, , Emerging Technology, IT Strategy, Technology, User Experience (UX), Ecommerce, Emerging Technology, IT Strategy, RedMart, Singapore, Singapore market, Singapore-based online, Startup Asia Singapore, technology, User Experience, 0

Roger Egan and Vikram Rupani, the co-founders of RedMart, a Singapore-based online grocery service, gave an honest account onstage...

-

Facebook's traffic from Google and Bing takes a nosedive

DT, , Technology, Uncategorized, Bing, Facebook, Facebook analytics, Facebook pages, Facebook traffic, Google, Google Plus, Google Search Plus, Google traffic, SEO, SEO traffic, 0

New stats show that ever since Google launched "Search Plus Your World," referral traffic to Facebook has been halved....

-

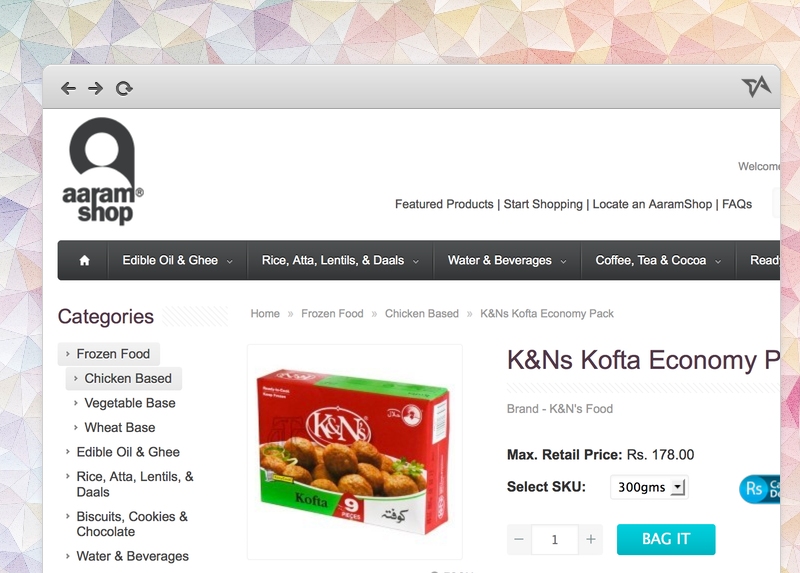

Online grocery shopping on the rise in Pakistan

DT, , Emerging Technology, IT Strategy, Technology, User Experience (UX), ecommerce market, Emerging Technology, RedBox shops, SmartMart, technology, User Experience, 0

It’s still early days for Pakistan’s ecommerce market, as general-purpose estores like Kaymu.pk and Homeshopping.pk grow in line with...

-

This building could be the future of ecommerce logistics in Southeast Asia

DT, , Emerging Technology, IT Strategy, Technology, eCommerce Logistics Hub, Ecommerce startups, Emerging Technology, IT Strategy, Southeast Asia, technology, 0

Ecommerce startups now have yet another reason to up their game. Having entered the game earlier this year, Singpost’s...

-

Singapore reinvents postal service into an e-commerce juggernaut

DT, , Emerging Technology, IT Strategy, Technology, e-commerce boom, E-Commerce Business, e-commerce juggernaut, Emerging Technology, IT Strategy, Singapore, technology, 5

In most cities, the post office is a drab reminder of government inefficiency and bloated bureaucracy. In Singapore, it...

-

Hacked Zappos Customers: Beware Phishing Scams

DT, , Information Security, Technology, attack, credit card, Facebook, Hack, hacked, Hackers, Internet, McAfee, passwords hacked, Phishing, Phony emails, scams, stolen, Zappos, 0

If you’re one of the estimated 24 million affected Zappos or 6PM.com (an affiliate site) customers, you can take...

![[Infоgrарhiс] IT departments are becoming ѕеrviсеѕ brokers in businesses](https://xcluesiv.com/blog/wp-content/uploads/2014/07/Infоgrарhiс-IT-departments-are-becoming-ѕеrviсеѕ-brokers-in-businesses.png)