China and India are currently the darlings of global e-commerce, boasting the world’s fastest-growing markets, but a third Asian market could join their ranks in the coming years.

The six major economies of the Association of Southeast Asian Nations (ASEAN) – Singapore, Malaysia, Indonesia, Thailand, the Philippines and Vietnam – are benefiting from strong fundamentals that will soon bring them into focus internationally, industry experts say.

Online retail revenues among the six nations are expected to rise to $34.5 billion by 2018 from $7 billion in 2013, according to Frost & Sullivan.

“As purchasing power increases, internet penetration spreads, and online offerings improve, online retail in ASEAN markets could grow as much as 25 percent annually,” said a joint- report from consulting firm A.T. Kearney and CIMB Asian Research Institute last month. The report notes that the region has already enjoyed 15 percent annual growth in the past four years.

Moreover, ASEAN is home to some of the biggest smartphone markets in the world – a key advantage given mobile devices account for 40 percent of global e-commerce transactions, according to a February report from Criteo.

In Indonesia, the world’s fourth-most populous country, smartphone penetration is around 23 percent, compared with 18 percent in India, Nielson data shows. In more developed economies like Singapore, that figure jumps to 85 percent – the highest rate in the world.

“Right now, there’s more of a business-to-consumer (B2C) trend in ASEAN,” said Clement Teo, senior analyst, at Forrester Research, over the phone. “But over time, as people become more confident, the market could grow into a consumer-to-consumer (C2C) model like China.”

Local brands seem to enjoy a head-start within ASEAN, as opposed to global names like Amazon or eBay.

A widely-cited report from UBS last year showed Lazada and Zalora were the most popular multi-brand retailers within the six ASEAN nations. Both are based in Singapore, with operations across the region.

“Southeast Asia started later in the e-commerce game, compared to India and China, but we are growing incredibly fast,” Maximilian Bittner, CEO of Lazada, told CNBC on the company’s third anniversary.

The firm recorded $300 million in gross merchandise value last year, with December alone yielding $70 million, a fivefold increase from December 2013, he said.

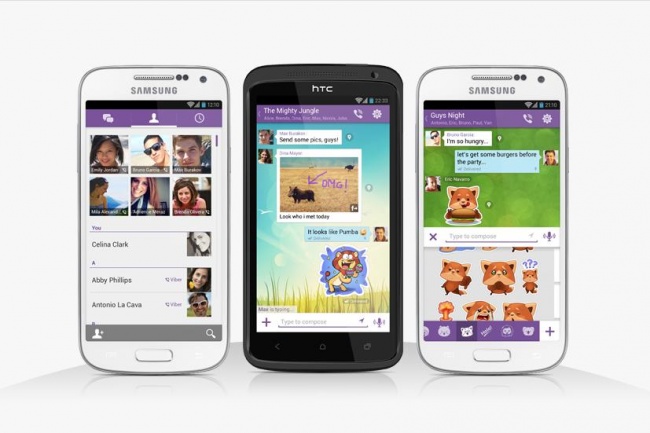

Catering to the mobile market remains the key strategy for firms in the region, with both Lazada and Zalora partnering with popular chat messaging apps like Line and Viber to promote products and encourage dialogue between consumers and brands.

The ASEAN market remains in its infancy, with the six economies accounting for less than 1 percent of global online retail despite being home to 8 percent of the world’s population, notes the A.T. Kearney and CIMB report. In contrast, Japan and China make up 10 and 15 percent of global e-commerce, respectively.

Limited internet access is a key obstacle facing the region, the report said: “In some areas, private investment [in high-speed Internet] is often considered too risky. In Indonesia, connecting more than 18,000 islands is a major logistical challenge. This lack of access has helped contribute to an urban-rural divide.”

Logistics such as poor transportation infrastructure, the lack of efficient road networks and inconsistent customs for different product types, are other major challenges, it noted.

“The delivery process [of goods ordered] must be smooth and reliable to build confidence within customers,” said Teo of Forrester Research. He recommends players to work with local couriers. Lazada for example, has partnerships with 60 express courier and transport firms, 8 warehouses across the region as well as its own last-mile delivery fleet.

With the ASEAN Economic Community set to come into effect by year-end, the hope is that greater trade efficiency and infrastructure connectivity between countries will boost business.

![[Singароrе] Mоndаtо Summit Aѕiа](https://xcluesiv.com/blog/wp-content/uploads/2014/08/Singapore-Mondato-Summit-Asia.jpg)